Cash flow is the lifeblood of any business. The speed at which your invoices are paid—known as debtor days—directly impacts your financial health. Managing debtor days is crucial to ensure a steady and predictable cash inflow.

In this blog, we will explore what debtor days are, how to calculate them, and strategies to accelerate customer payments. Our goal is to provide actionable insights to help you optimise cash flow and sustain business growth.

What are Debtor Days?

Debtor days measure the average time it takes for a business to receive payment after issuing an invoice. Unlike cash sales, credit sales involve a waiting period that can stretch your resources if not managed properly. Here’s a simple formula to calculate debtor days:

Debtor Days = (Total Accounts Receivable / Average Daily Sales)

Example Calculation:

For instance, if your business has $500,000 in accounts receivables and annual sales of $4,000,000, the average daily sales would be $10,958.90. Thus, your debtor days would be approximately 45 days. This means, on average, it takes 45 days for your customers to pay their invoices.

Why Monitoring Debtor Days Matters

Monitoring debtor days helps you manage your cash flow efficiently. High debtor days indicate a delay in receiving payments, which can strain your finances, affecting your ability to cover operational costs like wages, rent, and stock. On the other hand, low debtor days mean quicker cash inflow, improving liquidity and financial stability.

Cash flow issues are a significant stressor for 22% of small and mid-sized businesses, with late payments being a major contributing factor. Staying cash flow positive is critical to your business’s success.

According to a SME Growth Index report released by ScotPac, a massive 72.5% of small business owners reported having cash flow problems. Additionally, The Invoice Market’s SME Cash Flow Report cites that Australian small businesses are owed an average of $38,000 at any given point in time.

Having this amount of cash tied up can impede a business’ ability to fund operations, invest in growth, and, in some cases, survive.

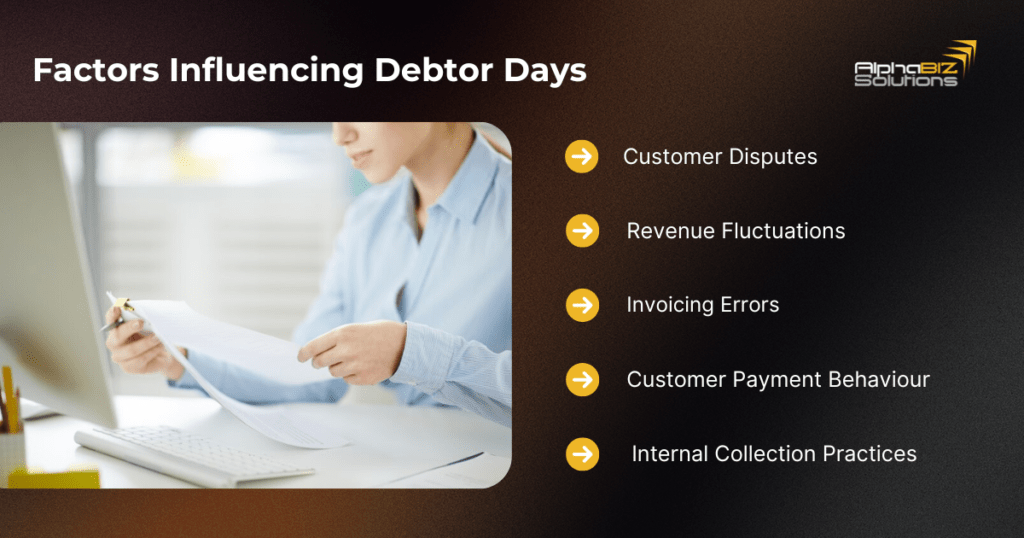

Factors Influencing Debtor Days

Several factors can affect debtor days, including:

1. Customer Disputes

Frequent disputes over invoices or service quality can delay payments. In the manufacturing and construction industries, these disputes can arise from discrepancies in project deliverables, material quality, or service timelines, leading to extended payment delays.

2. Revenue Fluctuations

Changes in sales volume can impact your receivables. In manufacturing, seasonal demand or fluctuations in production schedules can affect cash flow. Similarly, in construction, the cyclical nature of projects and varying contract sizes can lead to inconsistent revenue streams, influencing debtor days.

3. Invoicing Errors

Incorrect invoices or delayed dispatch can slow down payments. For manufacturers, errors in billing for materials, quantities, or delivery timelines can create confusion and delay payments. In the construction sector, inaccuracies in progress billing or milestone payments can lead to disputes and delayed collections.

4. Customer Payment Behaviour

Some customers may naturally have slower payment cycles. In both manufacturing and construction, dealing with large clients who have rigid payment processes can result in extended debtor days. Understanding and anticipating these behaviours can help in managing expectations and planning cash flow.

5. Internal Collection Practices

Inefficient receivables management can increase debtor days. In the manufacturing industry, a lack of coordinated follow-up on overdue accounts can lead to cash flow issues. Construction companies often face the challenge of managing multiple projects and clients simultaneously, making efficient receivables management crucial to reducing debtor days.

Current Trends and Challenges with Late Payments

In October and November 2023, a CreditorWatch survey of 198 Australian businesses revealed significant insights into the challenges faced with late payments. The survey showed that over 80% of businesses experienced late payments in the past six months, with 37% frequently facing delays of 60+ days.

Key findings from the survey include:

- 82% of businesses experienced late payments in the last six months.

- Businesses in Construction, Manufacturing, and Information, Media and Telecommunications industries had the highest proportion of late payments exceeding 45 days.

- Administrative and Support Services had the highest proportion of late payments under 10 days.

- 37% of businesses commonly experienced payments delayed by more than 30 days.

The most common delay periods among late payers were:

- Less than 10 days late – 23%

- 10-30 days late – 40%

- 30-45 days late – 17%

- More than 45 days late – 20%

Challenges Faced by the Manufacturing Industry

In the manufacturing industry, late payments can severely impact production schedules and supply chain management. Manufacturers often rely on timely payments to purchase raw materials and maintain production lines. Delays in receiving payments can lead to:

- Interrupted Supply Chains: Late payments can cause delays in procuring necessary materials, leading to production halts.

- Cash Flow Strain: Consistent late payments create cash flow challenges, making it difficult to cover operational costs like wages and maintenance.

- Project Delays: Without timely funds, projects may experience delays, impacting delivery timelines and customer satisfaction.

Challenges Faced by the Construction Industry

The construction industry also faces significant challenges with late payments. Given the nature of construction projects, which often involve multiple stakeholders and extended timelines, late payments can disrupt the entire project lifecycle. Specific challenges include:

- Project Delays: Construction projects rely heavily on milestone payments to progress. Late payments can delay project completion and increase overall costs.

- Resource Allocation: Delayed payments can affect the ability to hire skilled labour and procure necessary equipment and materials.

- Financial Stability: Frequent late payments can strain the financial stability of construction firms, leading to difficulties in managing multiple projects simultaneously.

Strategies to Reduce Debtor Days

1. Streamline Collection Procedures

Timely payment is crucial. Implementing regular follow-ups and reminders for overdue accounts is essential. Automated systems can send timely notifications, reducing the need for manual tracking. Establish clear credit guidelines and enforce stop-credit procedures for delinquent accounts.

2. Strengthen Customer Relationships

Good relationships can lead to faster payments. Maintaining open communication with clients is vital, especially when projects often face delays. Offer multiple payment options and seek feedback to address any issues promptly. Providing excellent customer support and addressing concerns immediately can encourage timely payments.

3. Leverage Technology

Use ERP systems to automate invoicing and receivables management. Where multiple invoices are often generated for ongoing projects, automation reduces errors and ensures timely follow-ups.

Debtor management solutions like ezyCollect can further streamline the process, making it easier to manage and collect payments. These tools can also integrate with project management software to provide real-time updates on payment statuses.

4. Offer Incentives for Early Payments

Consider providing small discounts for early payments. A 1-2% discount can significantly reduce debtor days by encouraging customers to pay before the due date. Evaluate the cost-benefit ratio to ensure it supports your cash flow goals. For large projects, offering milestone-based discounts can incentivise timely payments throughout the project’s duration

Conclusion

Managing debtor days is essential for maintaining healthy cash flow and ensuring business stability. By understanding the factors that influence debtor days and implementing effective strategies, businesses can accelerate customer payments and optimise their company’s financial health.

Adopting technology, improving customer relationships, and streamlining internal processes are key steps towards reducing debtor days and enhancing cash flow.

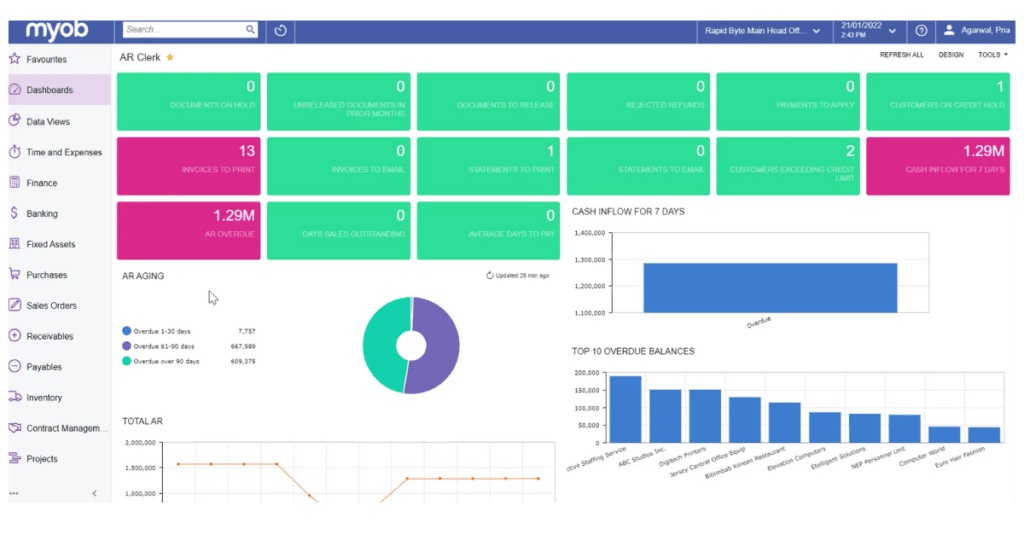

Reduce Debtor Days and Collect Faster with MYOB Acumatica

MYOB Advanced now known as MYOB Acumatica offers a comprehensive Accounts Receivable module that integrates with other advanced modules, providing a real-time single source of truth for your critical financial data. With features like automated invoice emailing, credit term management, and detailed AR-aged reports.

Through these features, businesses can streamline their receivables process and reduce debtor days significantly. The system’s ability to flag overdue accounts and automate follow-ups ensures faster collections and improved cash flow.

Ready to optimise your accounts receivable process and reduce debtor days? Book a non-obligatory demo with our expert MYOB consultants at AlphaBiz Solutions today!

FAQs About Debtor Days

Is High Debtor Days Good?

High debtor days are generally not good as they indicate that it takes longer for your business to collect payments from customers. This can strain cash flow and hinder your ability to meet operational expenses.

Do You Want High or Low Debtor Days?

You want low debtor days. Lower debtor days mean faster collections, which improves cash flow and financial stability.

What is a Good Debtor Days Ratio?

A good debtor days ratio varies by industry, but generally, fewer than 45 days is considered favourable. This ensures that payments are collected promptly, aiding in better cash flow management.

How to Improve Debtor Days Ratio?

To improve your debtor days ratio:

- Implement automated invoice reminders and follow-ups.

- Offer multiple payment options and early payment discounts.

- Regularly review and manage customer credit terms.

- Utilise technology like MYOB Acumatica to streamline and automate the accounts receivable process.