Single Touch Payroll (STP) reporting is a mandatory requirement for Australian businesses, ensuring that payroll data is submitted directly to the Australian Taxation Office (ATO) with every pay run. This system improves transparency, reduces administrative burdens, and ensures employees receive accurate superannuation and tax contributions.

With STP Phase 2 now fully implemented, mid-market businesses must navigate expanded reporting requirements, including detailed income types, employment conditions, and tax treatment codes. Failing to comply can result in penalties, making it essential for businesses to stay up to date with STP obligations.

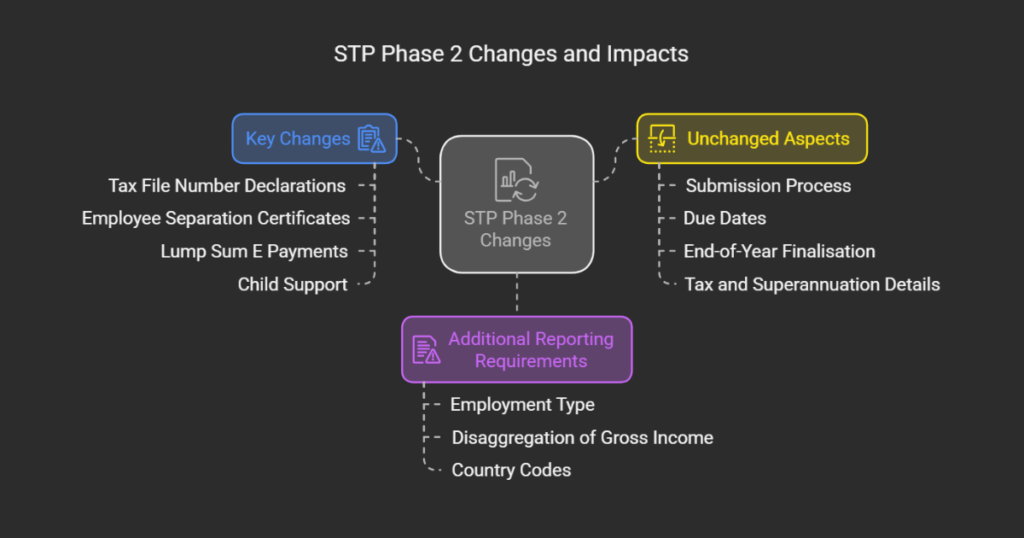

What’s Changed? STP Phase 2 Explained

STP Phase 2, introduced on 1 January 2022, requires businesses to provide more comprehensive payroll reporting. Here’s what’s new:

- Income Type Breakdown – Employers must categorize payments such as paid leave, overtime, bonuses, and salary sacrifice.

- Employment Conditions – Businesses must report employment types (full-time, part-time, casual) and cessation reasons when employees leave.

- Tax Treatment Codes – ATO can now determine how income is taxed based on employer submissions, reducing the need for additional reporting.

These changes aim to simplify interactions with government agencies, reducing the need for businesses to manually report payroll details across different departments.

Compliance Challenges for Mid-Market Businesses

Despite its benefits, STP reporting presents compliance challenges, particularly if you’re managing complex payroll structures. Here are some common hurdles you might face:

1. Keeping Up with Payroll Software Updates

You need to ensure that your payroll system is STP Phase 2-compliant. Without the latest updates, your reports could be rejected by the ATO, leading to delays and compliance risks.

2. Maintaining Data Accuracy

Accurately classifying payroll data is crucial. If you misreport allowances, superannuation, or termination payments, you could trigger compliance issues or even an ATO audit.

3. Avoiding Penalties for Late or Incorrect Reporting

The ATO imposes penalties for late submissions and incorrect payroll data. If you fail to stay compliant, you may face fines or increased scrutiny from regulatory bodies.

4. Managing Payroll Across Multiple Locations

If your business operates in multiple states, you’re dealing with different payroll tax thresholds and reporting requirements. Keeping track of these variations adds an extra layer of complexity to your compliance efforts.

What to Look for in a Payroll Solution for STP Compliance

When choosing a payroll system, ensuring compliance with Single Touch Payroll (STP) should be a top priority. A robust solution should not only simplify reporting but also provide automation, security, and real-time validation to reduce errors and administrative workload.

Here’s what to consider:

Automatic Tax-Filed Declarations

A good payroll system eliminates manual TFN declarations, ensuring new employee details are automatically submitted to the ATO, and exiting employees are finalized seamlessly.

Secure Setup and Compliance

Security is crucial in payroll reporting. Look for a system that offers two-factor authentication and direct integration with Standard Business Reporting (SBR) to establish a secure connection with the ATO.

Built-In Validation and Error Prevention

To avoid compliance risks, your payroll solution should have real-time data validation that flags any missing ATO categories or discrepancies before submission, helping you fix errors in advance.

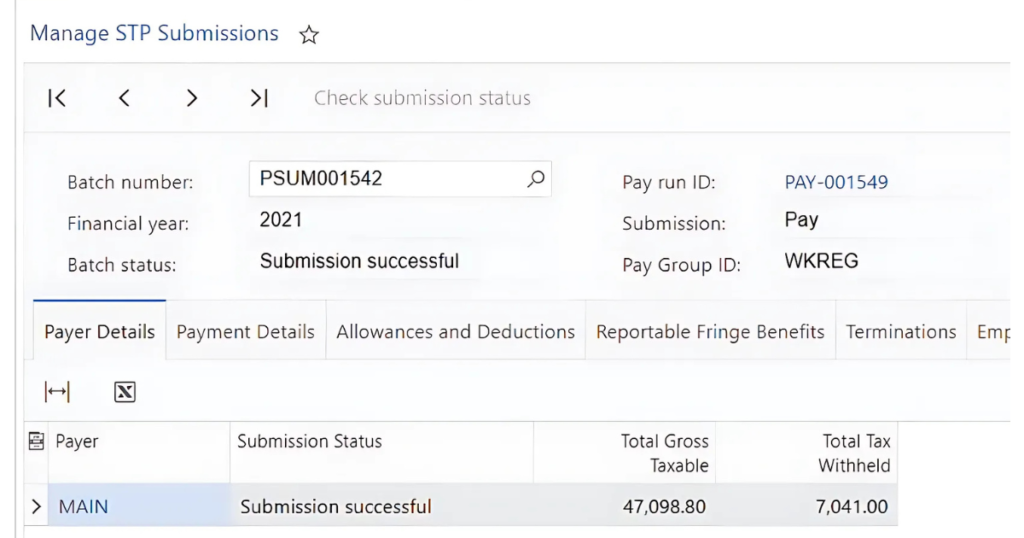

Effortless Pay Event Submission

An effective payroll system generates STP batches automatically with each pay run, ensuring year-to-date figures and terminations are accurately reported to the ATO without additional steps.

Easy Tracking and Finalization

You should be able to monitor all STP submissions in one place, verify their status, and finalize payroll at the end of the financial year, ensuring employees’ tax returns are correctly pre-filled.

Staying Up-to-Date with Compliance

Tax regulations change frequently, so look for a cloud-based payroll solution that updates automatically to align with the latest ATO requirements—reducing the burden on your payroll team.

MYOB Acumatica Payroll (formerly MYOB Advanced Payroll) checks all these boxes, offering a fully integrated, ATO-compliant fit for all-purpose payroll solution designed to keep mid-market businesses compliant while reducing manual work and errors. Investing in the right payroll system means focusing more on growth and less on compliance headaches.

Best Practices for STP Reporting Compliance

To stay compliant and avoid penalties, mid-market businesses should adopt the following best practices:

Review Payroll Categories Regularly

Ensure all wages, allowances, and superannuation contributions are categorized correctly according to STP Phase 2 guidelines.

Leverage Cloud Payroll Solutions

Using an ATO-approved payroll software like MYOB Acumatica Payroll ensures real-time compliance with the latest regulatory updates.

Train HR and Payroll Teams

Keeping your payroll team informed about STP updates reduces errors and improves compliance accuracy.

Conduct Regular Payroll Audits

Regularly reviewing payroll reports can help businesses detect and correct inconsistencies before they lead to compliance issues.

Stay Compliant with STP Reporting in 2025

STP reporting is more than just a compliance requirement—it’s a critical component of running an efficient and transparent payroll system. With the expanded requirements of STP Phase 2, mid-market businesses must stay proactive in ensuring accurate payroll reporting, keeping up with tax law changes, and avoiding costly penalties.

The right payroll solution makes compliance easier. MYOB Acumatica Payroll (formerly MYOB Advanced Payroll) offers automation, built-in validations, and seamless reporting to the ATO, helping businesses simplify payroll processes while reducing risks.

As a recognised MYOB partner, AlphaBiz Solutions helps businesses implement and optimise payroll solutions that keep them compliant and efficient. Whether you’re upgrading your payroll system or ensuring STP Phase 2 compliance, our team can provide expert guidance tailored to your needs.

Looking for an STP-compliant payroll solution? Contact us today to learn how MYOB Acumatica Payroll can streamline your payroll reporting!