Navigating changes in regulations is crucial for running a successful business. The recent increase in the Superannuation Guarantee (SG) rate to 11.5% is no exception. Staying informed and adapting your processes is essential to maintain compliance and ensure a smooth transition.

The Superannuation Guarantee Increase: Background and Reasons

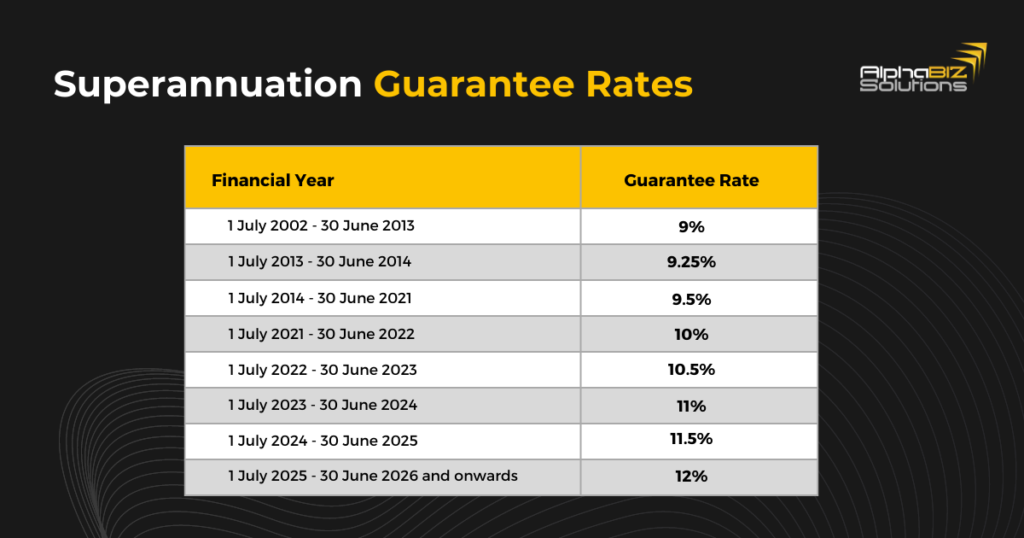

The Australian Government announced in 2021 that the SG rate would incrementally increase by 0.5% each year, aiming to reach 12% by 2025. This decision aims to reduce retirees’ reliance on the age pension and ensure they have sufficient funds for a comfortable and independent retirement.

The super guarantee has undergone a staged increase, allowing businesses time to adjust and prepare for these changes.

What Changes to Super Can You Expect This Year?

The Australian SG rate is set to rise to 11.5% from 1 July 2024. Eligible workers, including full-time, part-time, and casual employees, will start receiving higher contributions from their employers as the superannuation guarantee increases. This change will lift the current rate from 11% to 11.5% for the 2024-25 financial year.

Learn more about your superannuation obligations

The Impact of the Increase on Employers and Payroll Staff

With the superannuation rate set to increase to 11.5% on 1 July 2024, employers and payroll staff must be prepared for the financial implications and increased administrative workload. There is no grace period provided by the Australian Taxation Office (ATO) for adopting the new SG obligations.

Employers who fail to meet the requirements on time may be subjected to a Superannuation Guarantee Charge (SGC). This charge includes the owed SG amounts, interest, and ATO administration fees.

What You Need to Do

Update Your Payroll System

Ensure that your payroll system is updated to reflect the new SG rate of 11.5%. This will help you avoid any potential errors in calculations and maintain compliance with the revised requirements.

Updating Superannuation Guarantees in Your Payroll Systems

For those businesses using Sybiz Visipay, MYOB Advanced Payroll, or Wage Easy, below are the following steps to update the SG percentage.

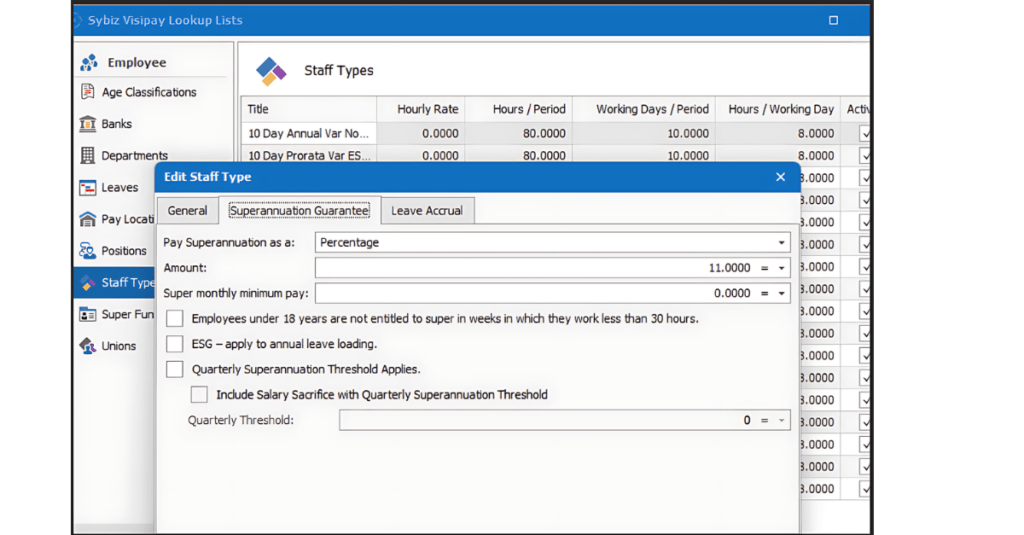

Sybiz Visipay

From Sybiz Visipay version 24.10 onwards, updating bulk superannuation rates has become much faster with the new Staff Type import facility.

To update superannuation rates in Sybiz Visipay:

- Select Utilities > Export > Employee Data, select Export From Staff Types,, and step through the wizard.

- Make the relevant changes and save the changes.

- To update the superannuation settings for the staff types, select Utilities > Import > Employee Data and select to Import To: Staff Types and step through the wizard.

- You will need to make the change after you have completed processing in 2023/24 and prior to processing your first pay in the 2024/25 financial year.

- If you are on a version prior to 24.10, we recommend upgrading to the latest version before the 2024/25 new financial year.

If you experience difficulty, please contact our expert Visipay consultants at AlphaBiz Solutions for assistance.

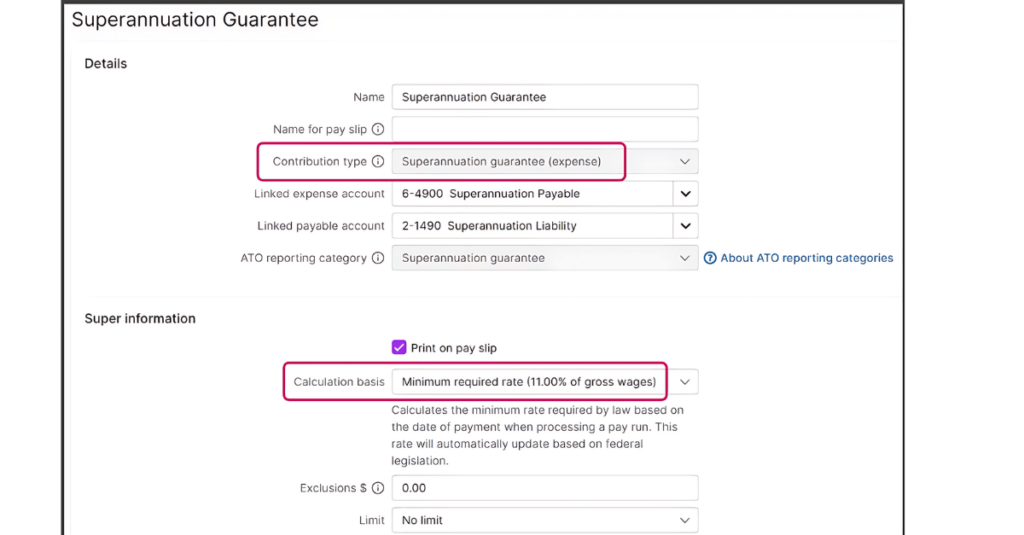

MYOB Advanced Payroll

Set and forget the super guarantee rate:

There is a calculation basis in your superannuation guarantee pay item called “Minimum required rate.” This option caters for the 1 July rate increase and will automatically update with any future rate increases.

You’ll see this option in all super pay items where the Contribution type is set to Superannuation guarantee (expense). For example, you’ll see it in your default super guarantee pay item (Payroll menu > Pay items > Superannuation tab > Superannuation guarantee).

This option will display as Minimum required rate (11.00% of gross wages) before 1 July, but from 1 July onwards, it’ll display as Minimum required rate (11.50% of gross wages). The Minimum required rate option means MYOB will automatically calculate the correct amount of super for your employees based on the Date of payment in the pay run.

What you need to do?

If you already have the calculation basis in your super guarantee pay item set to “Minimum required rate” as shown above, there’s nothing you need to do. The right amount of super will calculate in your employees’ pays.

But if the calculation basis is set to anything else, it might mean you’re paying a non-standard amount for your super guarantee contributions, and you should check to make sure it’s correct.

To check or change your super calculation basis,

- Go to the Payroll menu and choose Pay items.

- Click the Superannuation tab.

- Click to open the Superannuation guarantee pay item.

- For the Calculation basis, choose “Minimum required rate” to pay the mandatory minimum super guarantee contributions for the current, and future, payroll years.

- If you’re not paying the minimum super guarantee contributions for your employees, choose a different Calculation basis. If unsure, check with your payroll accounting advisor or the ATO.

- Select “User entered amount per pay” if you want to enter the super amount each time you do a pay run.

- Select “Equals a percentage of wages” and enter the super rate to be calculated and what it should be calculated on, e.g. Gross Wages.

- Select “Equals dollars per pay period” if you want to pay a set amount of super per pay period.

Using one of the above three options means you’ll need to manually manage any future super guarantee rate increases. Click Save to save your changes. If you use multiple superannuation pay items, we recommend checking each of them to see if the calculation basis is set correctly.

If you’re not sure about the impacts of any super rate changes on your business, check with your accounting advisor or the ATO.

FAQs:

What super rate applies to pays that span payroll years?

If you’ve chosen “minimum required rate” as the calculation basis in your super guarantee pay item, the applicable rate will be used based on the Date of payment in the pay run.

For example:

- If the Date of payment is June 30 or earlier, a super guarantee rate of 11.00% will apply.

- If the Date of payment is July 1 or later, a super guarantee rate of 11.50% will apply.

This means if the pay period includes dates in June and July, the Date of payment will determine which super rate will be applied.

What if my business chooses to pay a higher rate of super?

If you pay your employees more than the minimum super guarantee rate, you can either:

- Choose the calculation basis “Equals a percentage of wages” in the super guarantee pay item and enter the super rate you’re paying, or

- Use two super guarantee pay items to clearly show the additional super on your employees’ pay slips:

- In the first super guarantee pay item, choose the calculation basis “Minimum required rate.”

- Create a separate super guarantee pay item for the additional percentage. For example, if you pay 3% above the minimum super rate, set up the additional super pay item with the calculation basis set to “Equals a percentage of wages” and enter 3% as the percentage.

Both super pay items will show on your employees’ pay slips, making it clear they’re receiving a higher contribution. Learn more about Additional superannuation contributions.

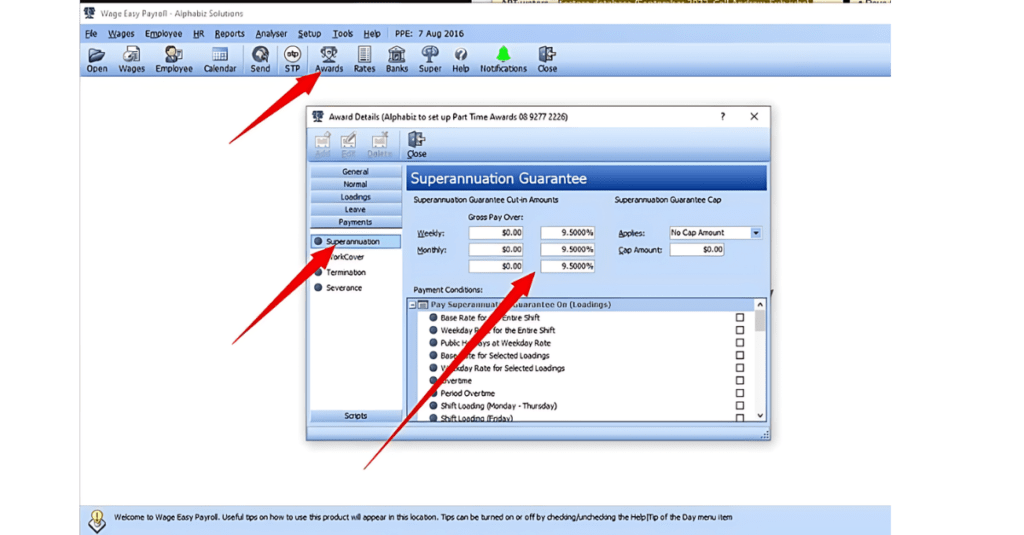

Wage Easy Payroll

Wage Easy Payroll provides you with great flexibility in meeting the business superannuation obligations and the superannuation needs of your employees.

Follow these steps to update your SG rate:

- Log in to the WageEasy Payroll platform using your credentials.

- Navigate and select “Awards”

- Look for the option to manage superannuation settings.

- Select the “Superannuation” or “Superannuation Guarantee” option to access the superannuation settings.

- Within the superannuation settings, you should find a field or option to update the superannuation guarantee rate.

- Enter the new superannuation guarantee rate (11% this 2023) according to the updated Australian legislation.

- Save the changes to update the superannuation guarantee rate in the WageEasy Payroll platform.

Get Expert Help and Learn More about Our ERP Solutions

If you need assistance updating your superannuation guarantee settings in Sybiz Visipay, MYOB Advanced Payroll, or Wage Easy, or if you want to explore the benefits of an all-in-one ERP system for your business, our expert team is here to help. We will guide you through the process to ensure your company remains compliant.

For those already using an ERP system, feel free to contact us for support. If you still need to implement an ERP system and are curious about its advantages, consider booking a demo with our experts today. Discover how an ERP system can streamline your operations and help you stay on top of compliance requirements, including the superannuation guarantee increase.