Sybiz recently hosted a Masterclass Webinar focusing on the crucial topic of GL consolidation. General Ledger (GL) consolidation is a pivotal process for businesses with multiple entities, ensuring accurate and streamlined financial reporting.

This guide will delve into the key information shared during the webinar, providing you with a thorough understanding of GL consolidation and how it can benefit your business. By the end of this guide, you’ll have a comprehensive grasp of the setup, features, benefits, and practical applications of GL consolidation.

Understanding GL Consolidation

GL (General Ledger) consolidation is the process of merging financial data from multiple ledgers into a single, unified ledger. This method is essential for businesses with multiple entities, as it simplifies financial reporting and enhances accuracy.

GL consolidation enables you to produce comprehensive financial reports that reflect the performance of related entities without the need for manual data manipulation.

The consolidation process involves collecting data from various subsidiary ledgers, mapping the accounts to a central chart of accounts, and then generating consolidated financial statements. This allows businesses to have a holistic view of their financial status, which is crucial for strategic planning and decision-making.

Key Features and Benefits of GL Consolidation

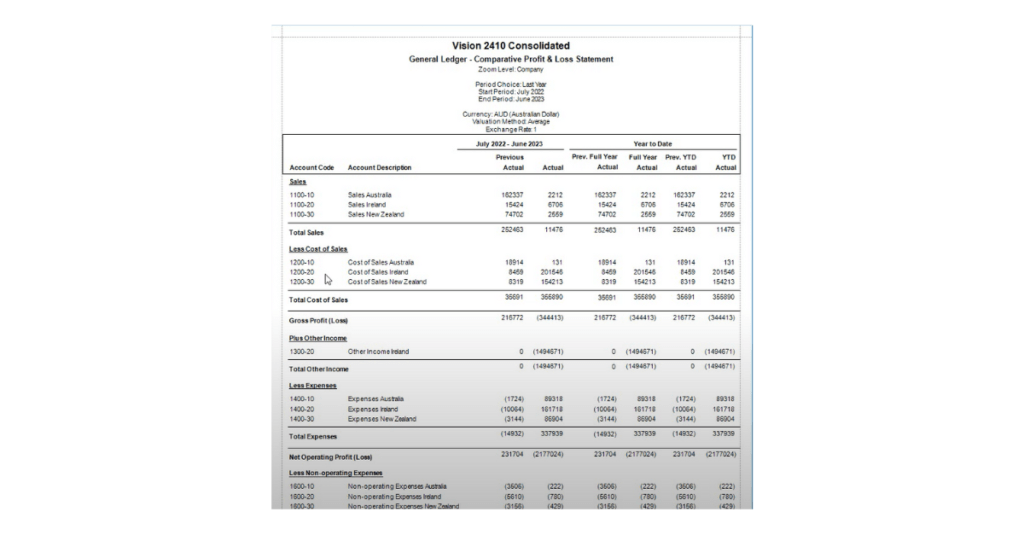

Streamlined Financial Reporting

GL consolidation allows for the creation of key financial reports that consolidate the performance of multiple entities. Instead of exporting data to Excel and manually consolidating it, the process automates these tasks, saving time and reducing the risk of errors. Once configured, the system can quickly update and reproduce financial reports, making the process efficient and reliable.

For example, if your business operates in multiple countries, you can generate consolidated reports that include data from all locations. This provides a clear picture of the company’s overall financial health and performance, aiding in informed decision-making.

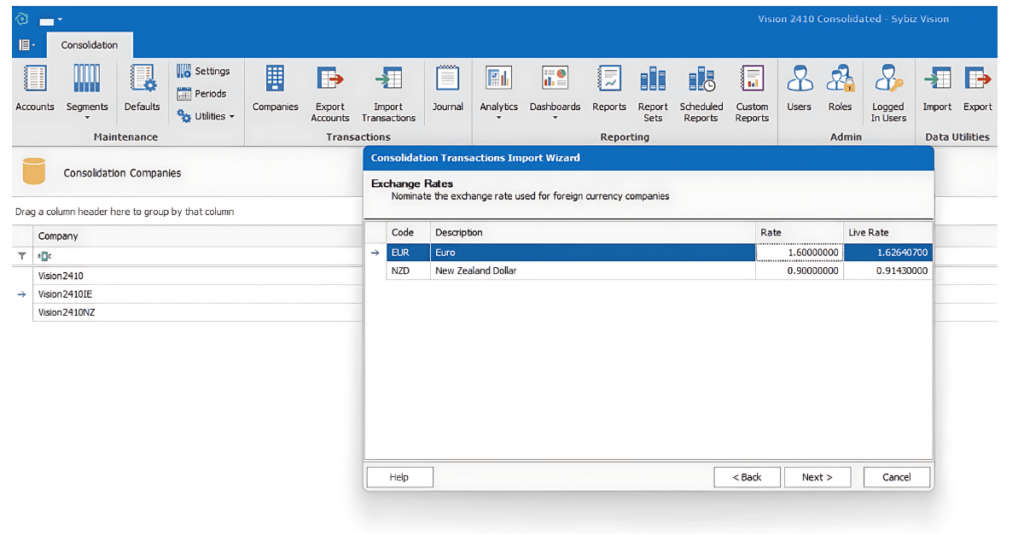

Multi-Jurisdiction and Multi-Currency Support

One of the standout features of Sybiz Vision’s GL consolidation is its ability to handle different base currencies and financial years. This flexibility is crucial for international businesses operating in various jurisdictions.

The system accommodates different financial year ends and allows consolidation across entities with varying base currencies without requiring a common chart of accounts.

This feature is particularly beneficial for businesses with subsidiaries in different countries. For instance, a company with entities in Australia, New Zealand, and the United States can consolidate financial data despite differences in currency and financial year ends.

This capability ensures that financial reports are accurate and reflect the true financial position of the entire organization.

Simplified Account Mapping

GL consolidation tool of Sybiz Vision offers an unconstrained mapping process. This means that accounts from different entities can be mapped to a parent chart of accounts regardless of their nature.

For example, a liability account in one subsidiary can be mapped to an asset account in the parent entity. This flexibility is particularly useful for managing intercompany transactions and ensuring accurate consolidated financial statements.

The unconstrained mapping process allows for greater flexibility and customization in financial reporting. Businesses can tailor their charts of accounts to meet specific needs, ensuring that all relevant data is accurately captured and reported.

Setting Up GL Consolidation

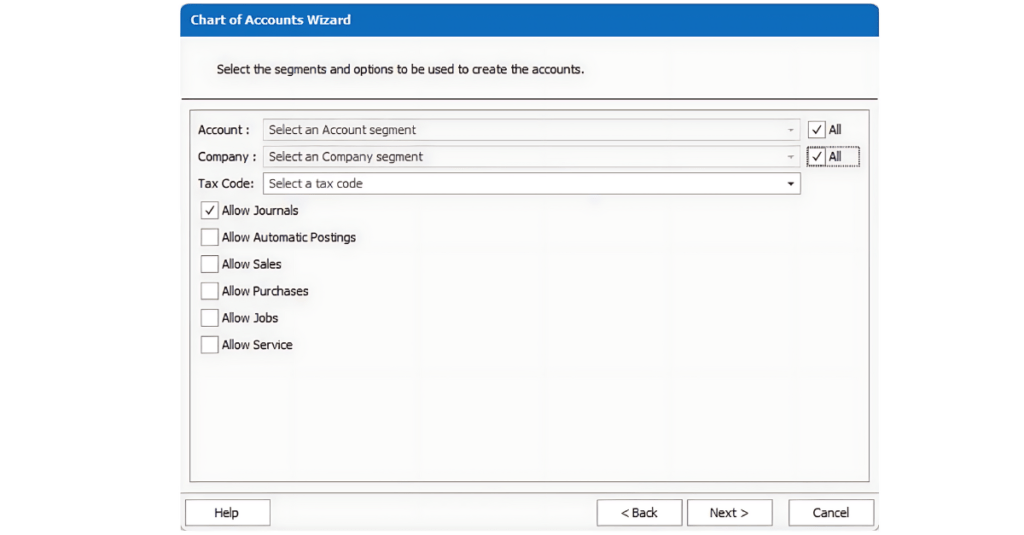

Creating the Consolidation Database

The first step in setting up GL consolidation is to create a consolidation database, also known as the parent database. This database will aggregate data from all subsidiary ledgers. It’s essential to define the structure and segments of your chart of accounts before proceeding to ensure a smooth setup.

When creating the consolidation database, consider the following steps:

- Define the Chart of Accounts: Determine the structure and detail of the chart of accounts for the parent database. This may differ from the subsidiary charts of accounts to accommodate consolidated reporting needs.

- Segment Definition: Establish segments within the chart of accounts to categorize data from different entities. Segments can include geographical locations, departments, or business units.

Once the consolidation database is set up, you can begin mapping the charts of accounts from each subsidiary.

Mapping Charts of Accounts

Once the consolidation database is created, map the charts of accounts from each subsidiary to the parent database. Sybiz Vision facilitates this process through an export-import mechanism, allowing you to streamline the mapping of accounts. This ensures that all financial data is correctly aligned and ready for consolidation.

The mapping process involves:

- Exporting Charts of Accounts: Export the chart of accounts from the consolidation database to each subsidiary.

- Mapping Accounts: Map each subsidiary account to the corresponding account in the parent database. This process can be automated using Sybiz Vision’s tools, reducing the risk of errors.

Proper mapping is crucial for accurate consolidated reporting. Ensure that all accounts are correctly aligned to reflect the financial data accurately.

Importing Transactions

Sybiz Vision uses a binge-and-purge approach for transaction imports. This method involves purging existing transactions and re-importing fresh data from subsidiary ledgers. This approach is beneficial for handling adjustments, back-posting, and currency exchange rate changes, ensuring that the consolidated data is always accurate and up-to-date.

The import process includes:

- Purging Old Transactions: Remove existing transactions in the consolidation database to prepare for new data.

- Importing New Transactions: Import updated transaction data from subsidiary ledgers. This ensures that all financial data is current and accurate.

This method simplifies the process of maintaining up-to-date consolidated financial statements, making it easier to manage adjustments and changes. For more detailed guidance on implementing GL consolidation, you can watch here.

Practical Applications and Use Cases

Handling Multiple Entities

GL consolidation is particularly useful for businesses with multiple entities. By consolidating financial data, you can produce comprehensive reports that reflect the overall performance of your entire business group. This capability is invaluable for strategic decision-making and financial planning.

For example, a multinational corporation with subsidiaries in different countries can generate consolidated financial statements that provide a clear picture of the company’s global financial performance. This aids in identifying trends, assessing risks, and making informed business decisions.

Managing Intercompany Transactions

The system’s ability to map accounts across different entities allows for efficient management of intercompany transactions. Whether dealing with intercompany loans, management fees, or other transactions, GL consolidation ensures these are accurately reflected in the consolidated financial statements.

Intercompany transactions can be complex, especially when dealing with multiple currencies and jurisdictions. Sybiz Vision’s GL consolidation tool simplifies this process by automating the reconciliation and reporting of intercompany transactions, ensuring accuracy and reducing the risk of discrepancies.

Simplifying Financial Reporting

With GL consolidation, financial reporting becomes more streamlined and less time-consuming. The system’s automated processes reduce the need for manual intervention, allowing your finance team to focus on analysis and strategic tasks rather than data manipulation.

For example, during the end of the financial year, businesses can quickly generate consolidated financial statements, reducing the time and effort required for financial reporting. This allows finance teams to focus on more value-added activities, such as financial analysis and strategic planning.

Key Considerations for Implementing GL Consolidation

Security and Authorization

When setting up GL consolidation, it’s essential to consider the security and authorization aspects. Each subsidiary database must be authorized to interact with the consolidation database. This ensures that only authorized users can access and modify financial data.

Sybiz Vision provides robust security features that allow businesses to control access to financial data. This is crucial for maintaining data integrity and ensuring compliance with regulatory requirements.

Default Accounts for Suspense and Rounding

During the setup process, it’s important to define default accounts for suspense and rounding. The suspense account is used to handle transactions that haven’t been mapped to a consolidation account, while the rounding account manages discrepancies arising from currency conversions.

These default accounts play a critical role in ensuring the accuracy of consolidated financial statements. Properly setting up these accounts prevents errors and ensures that all transactions are accurately accounted for.

Customising the User Interface

The consolidation company’s user interface in Sybiz Vision is simplified to focus on essential functions. This includes a streamlined set of reports and tools tailored for GL consolidation. Customizing the interface to suit your business needs can enhance efficiency and usability.

For example, businesses can customize the interface to highlight key reports and tools used for consolidated reporting. This ensures that users can quickly access the information they need, improving productivity and efficiency.

Conclusion

GL consolidation is a powerful tool that simplifies financial reporting and enhances the accuracy of consolidated financial statements. By leveraging Sybiz Vision’s capabilities, businesses can streamline their operations, save time, and reduce errors.

The setup process, while detailed, ensures that all financial data is accurately consolidated, providing a clear picture of the overall financial health of the business.

For further assistance and to explore how GL consolidation can benefit your business, contact AlphaBiz Solutions. Our team of experts is ready to help you navigate the complexities of financial management and achieve greater efficiency in your reporting processes.

With the right tools and support, mastering GL consolidation can lead to more accurate financial reporting and better-informed business decisions.