In the dynamic world of Australian business, eInvoicing is ushering in a pivotal transformation in how an astounding 1.2 billion invoices, primarily issued by small to medium-sized enterprises, are processed each year.

Moving away from the traditional approach, which is often mired in the risks of cyber fraud and the inefficiencies of manual handling, eInvoicing emerges as a solution to the costly and time-consuming challenges of invoice management.

This evolution sets the stage for our exploration into the myriad benefits of electronic invoicing for businesses and its seamless integration with MYOB, a leader in business management solutions.

As Australian Small Business and Family Enterprise Ombudsman Bruce Billson points out, the inefficiencies of the past—with 20% of invoices sent incorrectly and 30% containing errors, costing about $30 per paper invoice—are being effectively countered by eInvoicing.

With MYOB at the helm, the cost drops to under $10 per invoice, exemplifying not just a technological leap but a strategic move towards more streamlined, accurate, and secure business transactions.

What is eInvoicing?

eInvoicing, more than just sending digital invoices like PDFs via email, is a sophisticated system that enables the secure, standardized exchange of invoices between supplier and buyer systems.

This standardization allows different systems to communicate directly, eliminating manual data entry and reducing errors.

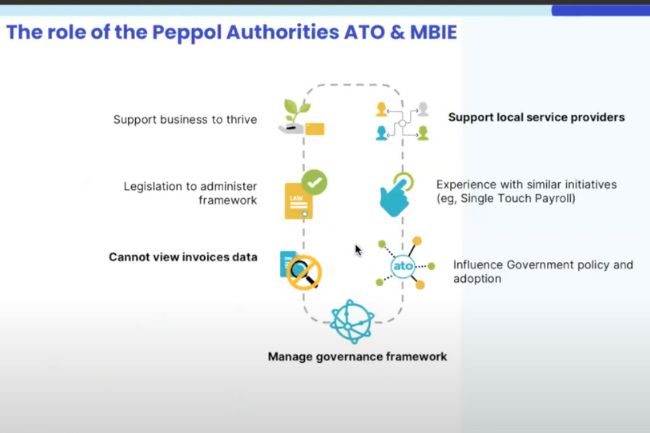

The ATO’s Role in Advancing eInvoicing

The Australian Taxation Office (ATO), as the Australian Peppol authority, plays a crucial role in eInvoicing by managing the network and setting specific standards, focusing on operational efficiency over compliance.

The ATO’s responsibilities include accrediting participants, defining Australia’s unique eInvoicing requirements, and ensuring system integrity. Additionally, the ATO promotes digital invoicing adoption by collaborating with businesses and digital service providers. This collaboration aims to establish a secure and efficient digital invoicing environment.

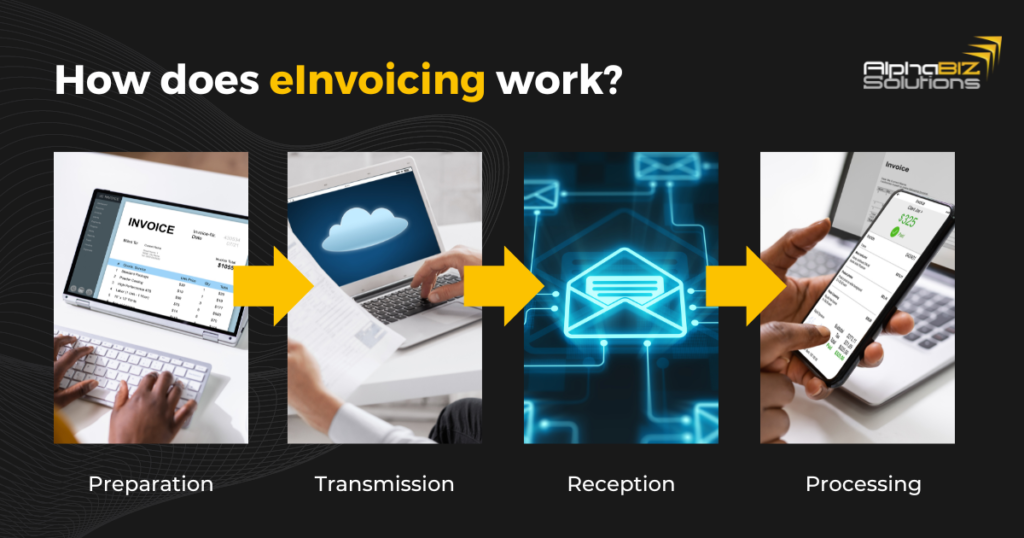

How does eInvoicing work?

Imagine eInvoicing as a telephone conversation between invoicing systems. In Australia, this system is based on the Peppol framework, an international standard for electronic procurement. Operated by the non-profit OpenPeppol, it uses a four-corner model:

- Preparation: The supplier inputs information into their system.

- Transmission: The supplier’s access point sends the invoice via the Peppol network.

- Reception: The buyer’s access point receives the invoice.

- Processing: The buyer processes and arranges payment.

The Australian Taxation Office (ATO) oversees the implementation of Peppol eInvoicing in Australia, making it accessible through various accredited service providers, including MYOB.

Benefits of eInvoicing

- Cost Savings: Replacing paper invoices with eInvoices can save businesses around $20 per invoice (Deloitte Access Economics, 2016). This includes savings from errors, chasing invoice payments, fraud, and scamming.

- Enhanced Efficiency: Automating the invoicing process reduces time and resource consumption.

- Faster Payments: Minimized errors lead to quicker invoicing and payments.

- Improved Security: eInvoices are more secure than email, reducing the risk of scams and fraud.

- Compatibility and Choice: The open standard of eInvoicing allows for compatibility with various software systems.

- Data-Driven Decisions: Accurate and timely data from eInvoicing aids in better financial and operational decision-making.

Mandatory eInvoicing – Who Does This Apply To?

Since July 2022, Australian Federal Government agencies have been mandated to adopt eInvoicing, a significant step in the nation’s digital transformation, emphasizing its critical role and efficiency in current business operations.

Furthermore, we strongly recommend its adoption for businesses of all sizes. In response to this growing trend, numerous Australian software providers, including MYOB, are proactively integrating eInvoicing capabilities into their offerings, demonstrating a commitment to modernizing financial processes in line with current standards.

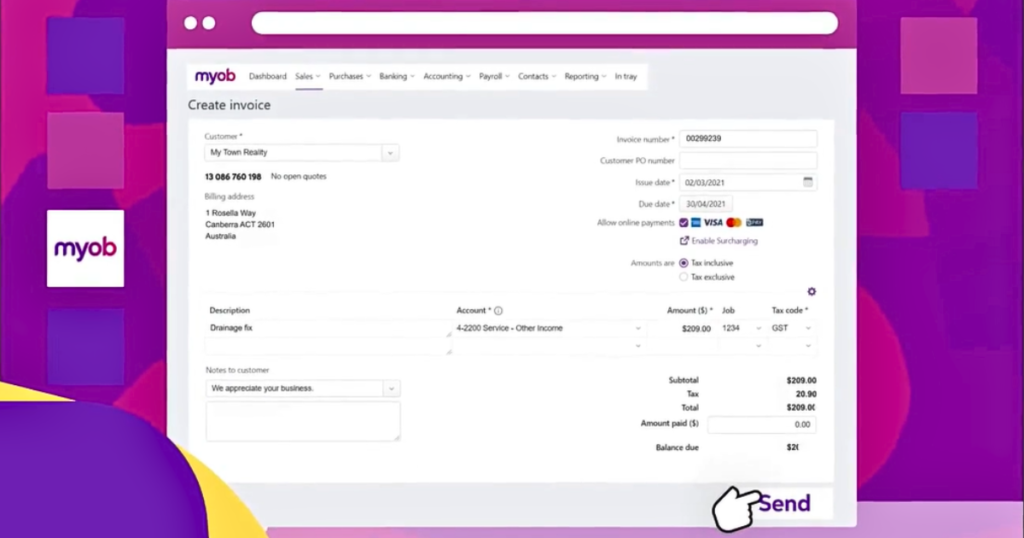

Key Features of MYOB’s eInvoicing Integration

MYOB’s integration of eInvoicing brings a suite of key features designed to enhance and streamline business operations. These features address invoicing’s practicality while aligning with broader goals like efficiency, security, and sustainability. Here’s a closer look at the key features of MYOB’s eInvoicing:

Accelerated Cash Flow

MYOB’s eInvoicing solution makes it easier for both B2G and B2B suppliers and customers to process and pay invoices swiftly. This efficiency is crucial in maintaining a steady cash flow, ensuring that businesses have the necessary funds for smooth operation and growth.

Reduced Administrative Burden

MYOB’s eInvoicing significantly reduces the time and effort spent on generating and sending invoices. This system minimizes human error by cutting down on manual handling and data entry, allowing businesses to focus their resources on more strategic tasks.

Enhanced Invoice Tracking and Control

MYOB provides businesses with the ability to track the status of their eInvoices. Users can see when invoices have been received, whether they are approved for payment, or if there are any issues, offering a level of control and transparency that is not possible with traditional invoicing methods.

Improved Security and Fraud Protection

Security is a paramount feature in MYOB’s eInvoicing. MYOB leverages the Peppol network’s built-in address database to ensure accurate delivery of invoices, enhancing financial transaction security and protecting businesses against fraud.

Eco-Friendly and Cost-Effective

MYOB’s eInvoicing aligns with the global shift towards sustainability, offering a paperless solution for businesses. It helps achieve environmental goals while reducing costs related to paper, printing, and postage.

Conclusion

eInvoicing represents a significant advancement in digital business operations. Integrated with MYOB, it provides Australian businesses with a robust solution for efficient, secure, compliant invoicing processes. Embrace the future of invoicing with MYOB and take a step towards streamlined business success.

Let AlphaBiz Solution Help Modernise your e-Invoicing with MYOB Advanced

If you’re ready to leverage the benefits of eInvoicing with MYOB Business, AlphaBiz Solutions is your ideal partner. Our ERP experts can show how MYOB Advanced transforms invoicing with efficiency, security, and sustainability.

Contact us to book a personalized session and experience the transformative power of MYOB’s eInvoicing solution, ensuring your business stays ahead in the digital era.