As the end of the financial year 2024 approaches in Australia, it’s essential to ensure that your payroll processes are compliant and running smoothly. This guide provides a comprehensive checklist to help you navigate the compliance changes and prepare for the new financial year using MYOB Advanced Payroll.

EOFY 2024 MYOB Advanced Payroll Checklist

1. Catch up on Latest Compliance Changes

2. Ensure Accurate Data and System Setup

2.1. Check Company and Contact Details

2.2. Check pay item and pay distribution details

2.3. Check taxation details

3. Reporting fringe benefits

3.1. Create a fringe benefit pay item type

3.2. Update reportable fringe benefit amounts

3.3. Load reportable fringe benefit amounts

3.4. Send the pay event data to the ATO

4. Finalise your STP reporting

To get started with these procedures, make sure you complete and close all pays for the tax year being updated.

Note: You must complete these procedures before completing the first pay in the new financial year.

1. Catch up on Latest Compliance Changes

Starting from 1 July 2024, several compliance changes will come into effect. MYOB Advanced Payroll will automatically apply most new rates and thresholds. Here’s what you need to know:

- PAYG Tax Rates for Residents:

- Income $18,201 – $45,000: 16% (reduced from 19%)

- Income $45,001 – $135,000: 30% (reduced from 32.5%)

- Income over $190,000: 45% (previously applied to income over $180,000)

- PAYG Tax Rates for Non-Residents: Updated rates for different income levels (refer to the ATO website for detailed tables).

- Shearing and Horticultural Industries: For foreign residents with a TFN, the rate is now 30% (reduced from 32.5%).

- Medicare Levy Exemptions: Updated tables for seniors and pensioners with full and half exemptions.

- Working Holiday Makers: Specific tax rates based on registration status as an employer of WHMs.

- Return-to-Work Payments: Withholding rate reduced to 32% (from 34.5%).

- Medicare Levy Surcharge Thresholds: Updated thresholds effective from 1st July 2024

If any of your employees’ Medicare levy surcharge changes as a result of the new thresholds, update their pay details:

-

Go to the Pay Details form (MPP3120).

-

Select the employee, and open the Taxation tab.

-

In the Medicare Levy Variation Declaration section, select the new Surcharge rate and MLS tier. If the employee is no longer required to pay a surcharge, select No for Levy surcharge (MLS)?

- Student Loans: Minimum repayment threshold increased from $51,532 to $54,435.

- Employee Termination Payments (ETP):

- ETP cap increased to $245,000.

- Genuine redundancy and early retirement scheme payments updated.

- Superannuation:

- Super guarantee rate increases to 11.5%.

- Maximum super base contributions increased to $65,070 per quarter.

2. Ensure Accurate Data and System Setup

Having accurate data is fundamental to a seamless EOFY process. Here’s a checklist to verify your data and system setup:

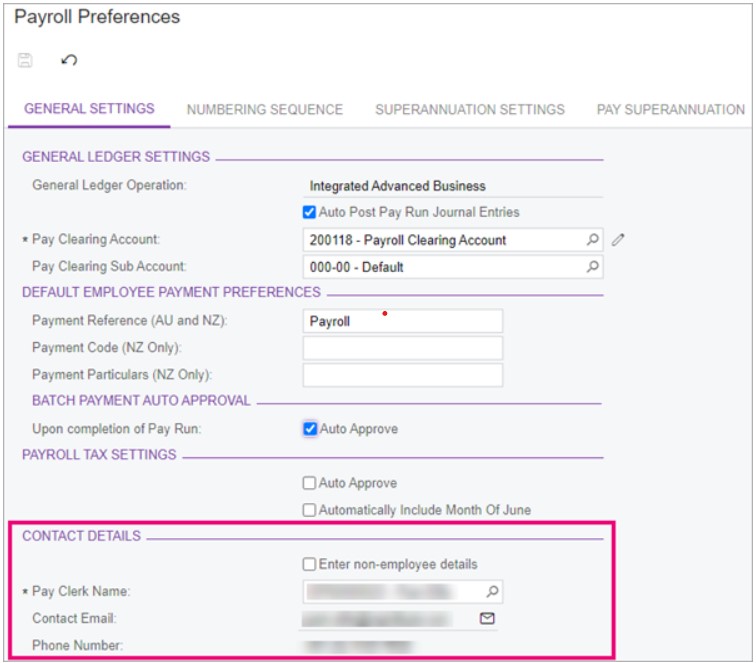

Check Company and Contact Details

Company ABNs

On the SBR Registration tab of the Payroll Preferences screen (MPPP1100), make sure that each company has an ABN and software ID.

Contact details

On the General Settings tab of the Payroll Preferences screen, make sure that the contact details are correct for the person in your company who’s in touch with the ATO.

Company data

Ensure that the details on the Companies screen are correct (CS1015PL).

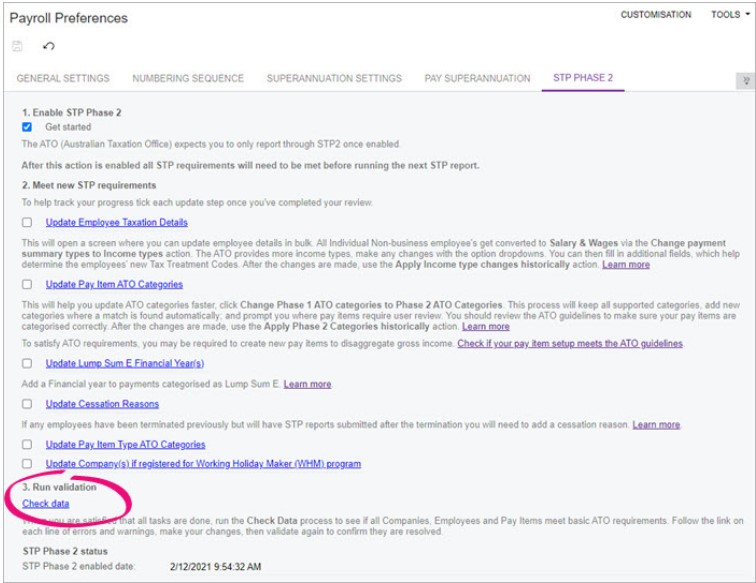

MYOB Advanced Payroll possesses an inbuilt functionality designed to identify discrepancies in your data. Originally, this attribute was developed to verify data for Single Touch Payroll. However, it can also be utilised ahead of a new financial year.

There are two locations within MYOB Advanced Payroll where this feature can be employed.

- If you’re using STP Phase 1, you can use the Check Company Data screen (MPPP5020).

- If you’re using STP Phase 2, you can click Check data on the STP Phase 2 tab of the Payroll Preferences screen (MPPP1100)

Check pay item and pay distribution details

Pay distribution

For each employee, go to their Pay Details screen and make sure that the information on the Settings and Pay Distribution tabs are correct.

Pay items

Make sure that pay items are configured correctly. For example, that pay item categories are correctly set up for STP reporting.

Check taxation details

Taxation

For each employee, go to their Pay Details screen and make sure that the information on the Taxation tab is correct. You should verify their residency status, tax offsets, student loans etc. are set up correctly for taxation purposes.

Payroll taxation

For each employee, go to their Pay Details screen and make sure that the information on the Payroll Taxation tab is correct.

3. Reporting fringe benefits

If your employees receive reportable fringe benefits, these must be reported to the ATO via an STP pay event.

- Setting up MYOB Advanced Payroll for reporting exempt and non-exempt fringe benefit payments

- Loading reportable fringe benefits amounts

- Sending pay event data to the ATO.

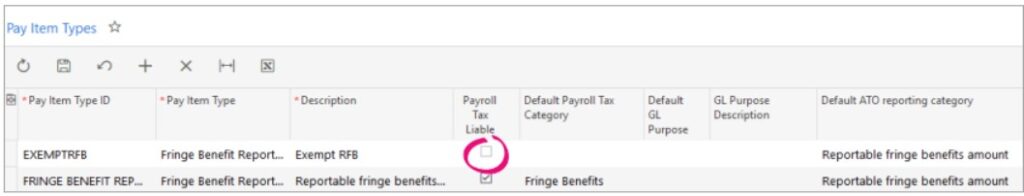

Create a fringe benefit pay item type

By default, MYOB Advanced Payroll includes a Fringe Benefit Reporting pay item type, which you can assign to fringe benefit pay items that are liable for payroll tax. However, you need to create another pay item type for fringe benefits that aren’t liable for payroll tax.

- Go to the Pay Item Types screen (MPPP2160).

- On the form toolbar, click the Add Row icon :ADV_Plus:.

- Complete the Pay Item Type ID, Pay Item Type and Description fields.

- Leave the Payroll Tax Liable checkbox unselected.

- On the form toolbar, click the Save icon :ADV-Save: .

Create fringe benefit pay items

To correctly update MYOB Advanced Payroll for reportable fringe benefits, you’ll need up to four pay items with different settings for how the amounts will be reported.

The table below shows which settings to select for different types of reportable fringe benefits. You can select these settings on the Additional Info tab of the Pay Items screen (MPPP2210).

See the creating a pay item if you need a refresher.

Update reportable fringe benefit amounts

The fringe benefit tax year is from April 1 2024 to March 31 2024. The Pay Period End Date should be no later than March 31 2024.

If the Pay Period End date is after March 31 2024, the reportable fringe benefit won’t appear in the correct fringe benefit tax year.

The Physical Pay Date needs to be in June 2024, otherwise the pay event sent to the ATO will be rejected.

Employees can only be added to a current pay run on the fly if their pay frequency matches the pay run frequency. If they are added to a current pay run, then the standard pay of that frequency is brought into the pay run. To avoid having to go into each employee and manually delete the pay elements, we recommend adopting the following workflow to update reportable fringe benefits.

In this workflow, the fringe benefit amounts will be updated using a new pay group with the Pay Frequency set to Annually.

- Go to the Pay Groups screen (MPPP2710).

- On the form toolbar, click the Add Row icon :ADV_Plus: .

-

In the new row, complete the fields as follows:

-

Pay Group ID – ARFB

-

Description – Reportable Fringe Benefits

-

Hours per Day – 0.0000

-

Hours per Pay – 0.0000

-

Hours per Year – 0.0000

-

Pay Frequency – Annually

-

Pay Default – N/A

-

Last Pay Period Start Date – 01/04/2023

-

Last Pay Period End Date – 31/03/2024

-

Last Physical Pay Date – 21/06/2023

-

Active – click if yes

-

- Go to the Employee Pay Groups screen (MPPP2250).

- Add the ARFB pay group you created to each employee to be updated.

- Select the Employee from the search window or enter the Employee ID.

- Add the new Reportable Fringe Benefits pay group.

You can go into each Pay Details for each employee attached to the Reportable Fringe Benefit pay group and add the Pay Item to the Standard Pay or you can add the pay item to a current pay on the fly.

Load reportable fringe benefit amounts

- Once all the employees have been updated then go to the Manage Pays form (MPPP4110) and from the Actions dropdown list Create Pay.

- Select the new pay group and click OK.

- Once the pay is OPEN then “View Pay Run”.

Reminder:

When Single Touch Payroll (STP) is active in MYOB Advanced Payroll, you MUST enter a date for the Physical pay date; no later than 30th June of that financial year. Having a Physical pay date of 31st March would be outside of ATO reporting requirements. - Open each employee’s pay and add the Reportable Fringe Benefits (RFB) pay item that matches the reporting requirements of that employee’s fringe benefit.

Send the pay event data to the ATO

-

After updating all employees for RFB, click on the Pay Run ID to return to the pay run.

- Process pay run

a. On the Pay Run Details form (MPPP3120) from the main toolbar, select Process.

A Pay Run popup will appear.

b. Once you select OK you can only cancel or complete the Pay Run. The Pay Run Status changes to PROCESSING.

3. Complete pay run

a. Staying on the Pay Run form, from the main toolbar, select Complete.

The following Pay Run popup appears:

b. Once you select OK, the pay event declaration will appear

c. Once you tick the checkbox I agree, and then select OK, the pay event declaration will appear. The Pay Run is complete.

4. Finalise your STP reporting

The last step for end-of-financial-year procedures is to finalise your STP reporting. On the STP Finalise screen (MPPP5023), you can submit a finalisation event to the ATO. You must send your finalisation event for the current tax year before July 14 2024.

After finalising, your employees can access their information in ATO site to complete their income tax return.

For more information about finalising your STP reporting, see Single Touch Payroll. These pages also cover the changes for STP Phase 2. All customers must use STP Phase 2 unless you have a deferral from the ATO.

If you’re an employer with closely held payees, you can find more information on the ATO website.

Let Alphabiz Solutions Guide You Through EOFY 2024 MYOB Advanced

Still feeling daunted by the EOFY process? Our team of seasoned MYOB Advanced consultants is on hand to guide you through the process, ensuring a seamless transition into the new financial year.

Avoid the risk of incurring any ATO penalties. – it’s a common pitfall that can result in unnecessary cost and stress. Why take the risk when expert help is just a phone call away? Book a call with us today, and we’ll help you prepare your MYOB Advanced Payroll system, keeping you compliant and confident as you navigate EOFY 2023.